13 Jan Virginia Mercury Publishes Eric Hurlocker Article on Impact of Inflation Reduction Act “Direct Pay” Provision for Tax-Exempt Entities

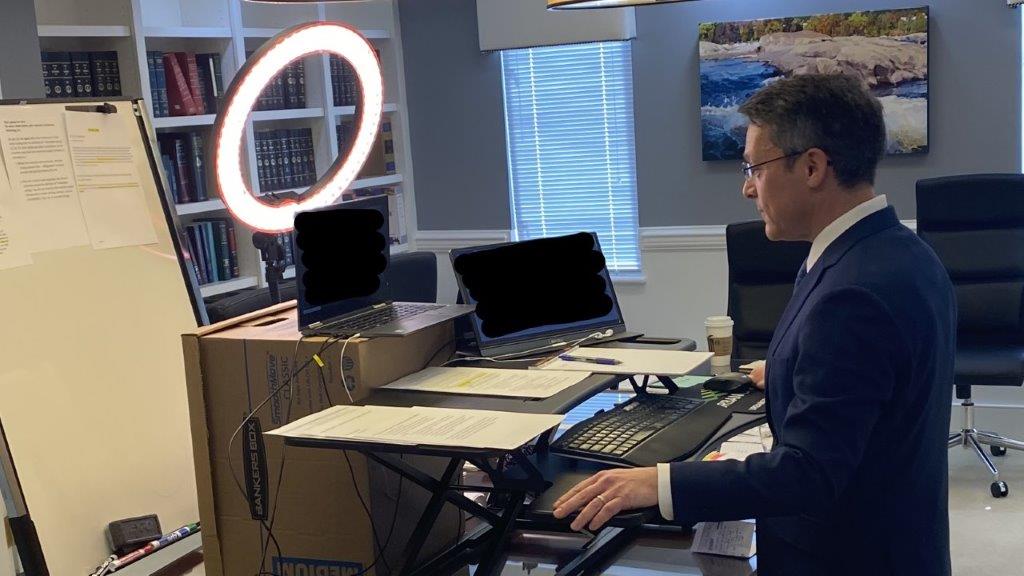

GreeneHurlocker partner Eric Hurlocker recently wrote a commentary piece published by the Virginia Mercury addressing the implications of the Inflation Reduction Act's "direct pay" provision on tax-exempt entities. Historically, federal tax incentives for investments in renewable energy projects were geared to individuals and entities with taxable...